unrealized capital gains tax canada

Under Canadian income tax law gains or losses on income account are fully included. When to report a gain or loss.

Capital Gains Tax Canada Explained

The good news is you only pay tax on realized capital gains.

. If the current value of the investment or holding is less than the original purchase price you have a capital loss. In Canada 50 of your capital gain is taxable. Deduct this ACB from the sale price.

If you earned a capital gain of 10000 on an investment 5000 of that is taxable. Instead when you incur a capital gain in Canada. This gain is something that Bob would have to report on his income tax.

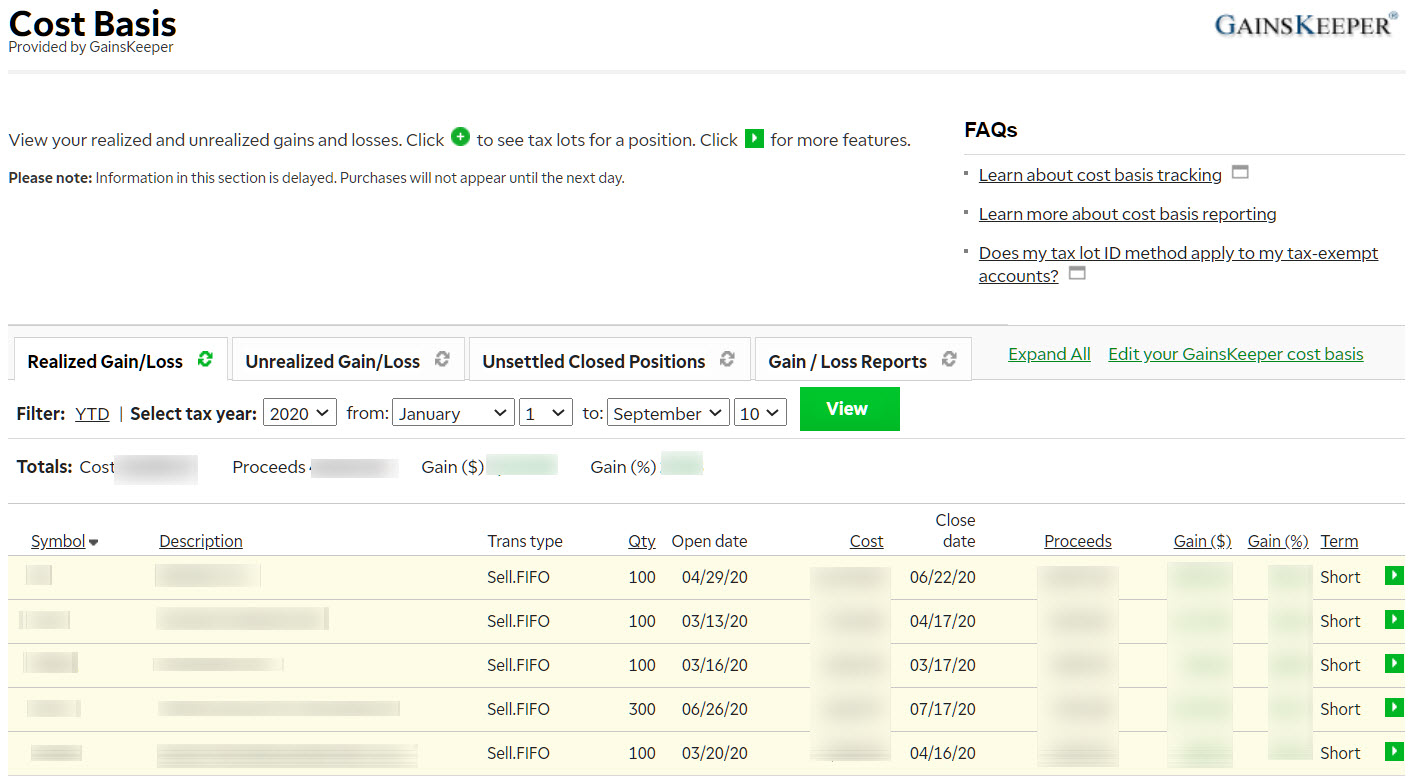

Since he purchased the BTC back in 2020 for 20K CAD he has now realized a gain of 40000 CAD. Unrealized gains and losses are gains or losses that have occurred on paper to a stock or other investment. The sale price minus your ACB is the capital gain that youll need to pay tax on.

In our example you would have to. Investors pay Canadian capital gains tax on 50 of the capital gain amount. As we head toward another federal budget to be released on March 22 there is much speculation about a change in the capital gain inclusion rate from 50 to 6667 or 75.

Unrealized capital gain is when the value of stock has increased but you haventsold it. This means you have a capital gain because its more than your ACB. How much tax do you pay on stock gains in Canada.

Until you do there is no. For example if you were ahead of the curve and bought bitcoin for 100 and. There is no unrealized gain tax so you wont report unrealized gains or losses on your tax filings.

The capital gains tax only applies to realized capital. Do you have to report unrealized gains Canada. As mentioned youre required to pay tax on realized capital gains.

There is no unrealized gain tax so you wont report unrealized gains or losses on your tax filings. Multiply 5000 by the tax rate listed according to your annual income minus any selling costs. One of the most common questions we receive from Americans.

As the rules are currently written only 50 of a capital gain is subject to tax in Canada. In Canada 50 of the value of any capital gains is taxable. Capital gain taxes only kick in when you sell your stock.

Capital gains meaning earnings from selling an asset for more than you bought it are taxable under federal tax law. This means that if you earn 1000 in capital gains and you. You report the disposition of capital property in the calendar year January to December you sell or are considered to have sold the property.

Completing your income tax return. A capital gains tax is a levy on the profit that an investor makes. Unfortunately there isnt a specific tax rate for capital gains.

The price could change before you. In this commentary we discuss the findings from our new research on the estimated impact of the 1994 reform that dramatically increased the tax rate on capital gains. On line 12700 enter the positive amount from line 19900 on your Schedule 3If the amount on line 19900 on your Schedule 3 is negative a loss do not.

American citizens living in Canada for more than five years face an imposed exit tax on unrealized gains. 7950 2400 5550.

Capital Gains Tax In Canada 2022 50 Rule Fully Explained

Individuals Pay Very Little Individual Income Tax On Capital Income Tax Policy Center

Capital Gain Definition Types Corporate Tax Rates Example

It S Time To Increase Taxes On Capital Gains Finances Of The Nation

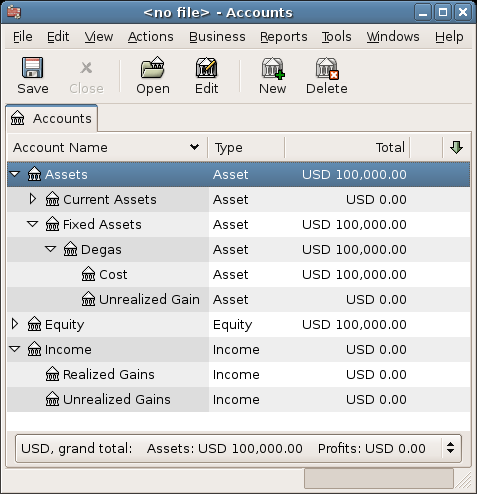

Crypto Tax Prep We Help You Save On Taxes Kpoinly Koinly

Canadian Change Of Use Rules For Cross Border Real Estate Cardinal Point Wealth Management

Understand Taxes For Investing A Guide For Canadian Beginners Wealthy Corner

Cost Basis Capital Gains Losses And Mythical Beings Ticker Tape

Short Term And Long Term Capital Gains Tax Rates By Income

What Is Unrealized Gain Or Loss And Is It Taxed

Proposed Tax On Billionaires Raises Question What S Income The New York Times

Billionaire Tax Faces Likely Constitutional Challenge Wsj

Canada Crypto Tax The Ultimate 2022 Guide Koinly

The Tax Break Down Preferential Rates On Capital Gains Committee For A Responsible Federal Budget

Opinion This Plan To Force The Wealthy To Pay Yearly Capital Gains Taxes Won T Solve The Real Problem Marketwatch

Is There An Unrealized Gains Tax On Cryptocurrency Coinledger

Short Term And Long Term Capital Gains Tax Rates By Income

Time For Capital Gains Harvesting From Your Corporation Physician Finance Canada

Capital Gains Tax Hike And More May Come Just After Labor Day